UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x¨ Preliminary Proxy Statement

¨ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

PCB Bancorp

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PCB BANCORP

3701 Wilshire Boulevard, Suite 900

Los Angeles, CA 90010

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF PCB BANCORP:

NOTICE IS HEREBY GIVEN that, pursuant to its bylaws and the call of its Board of Directors, the Annual Meeting of Shareholders (the “Annual Meeting”) of PCB Bancorp (the “Company”) will be held as follows:

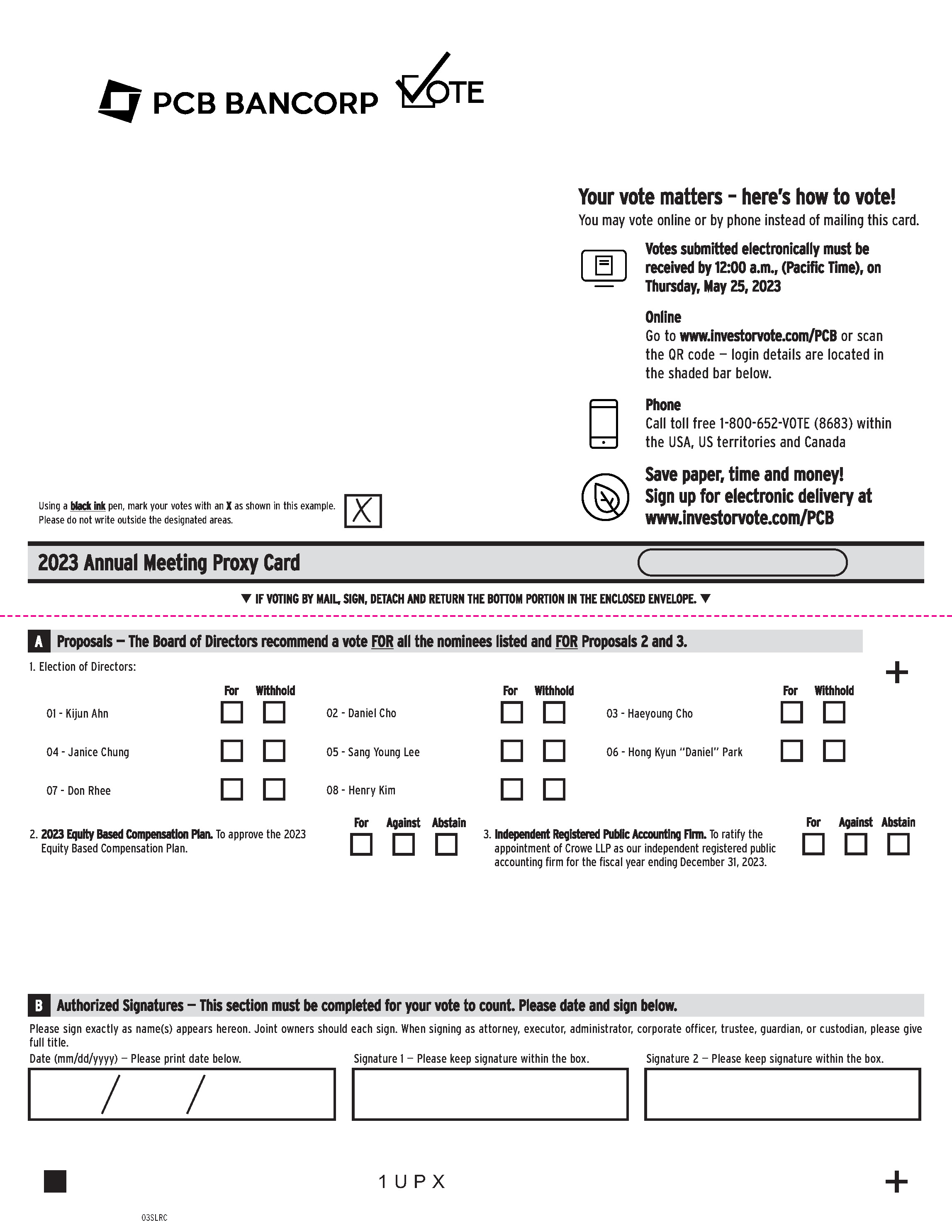

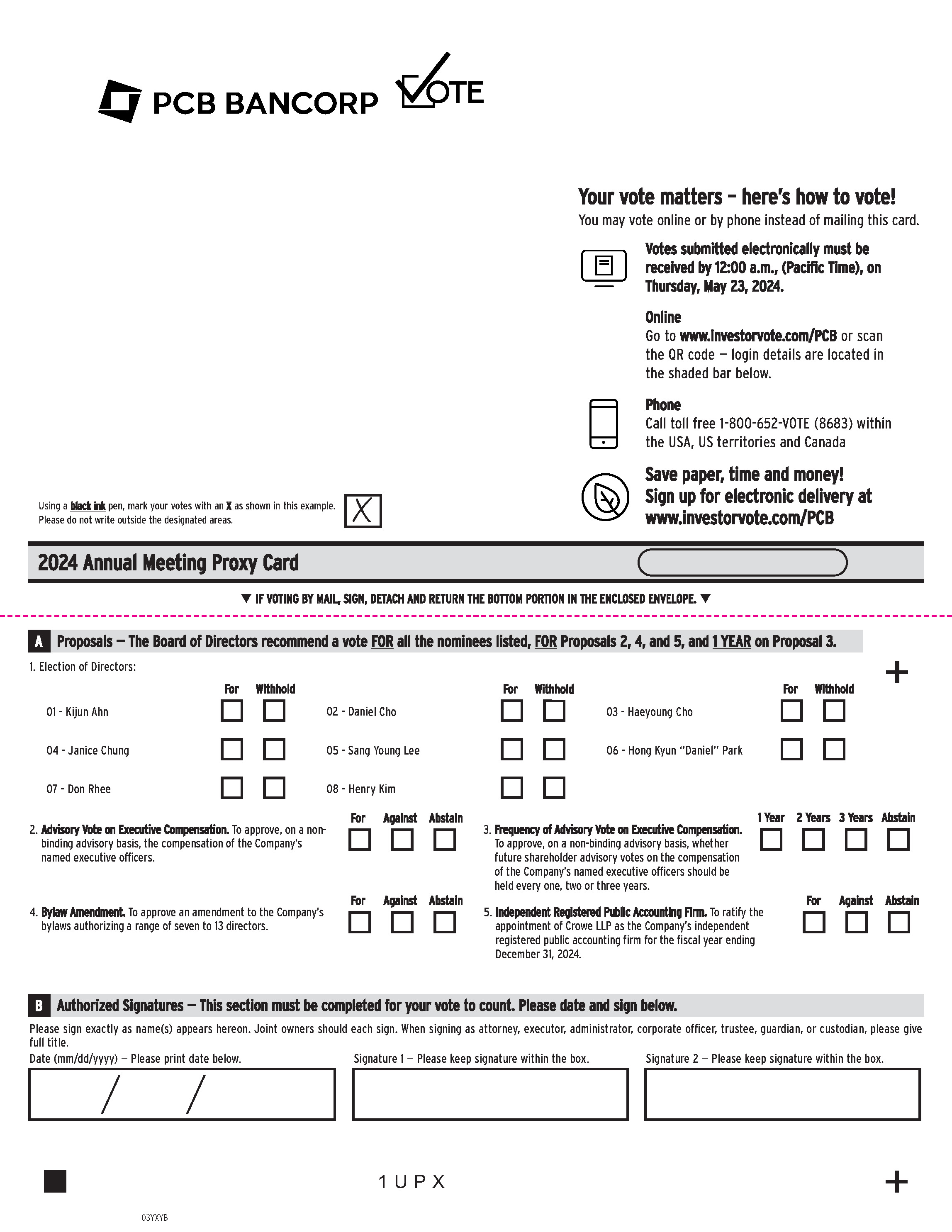

Date: Thursday, May 25, 202323, 2024

Time: 10:30 a.m., Pacific Time

Place: The Board RoomPCB Bancorp Headquarters

3701 Wilshire Boulevard, Suite 900

Los Angeles, California

At the Annual Meeting, shareholders will be asked:

1.Election of Directors. To consider and vote upon a proposal to elect eight (8) persons to the Board of Directors of the Company to serve until the next Annual Meeting and until their successors have been elected and have qualified. The Board of Directors has nominated the following persons for election:

| | | | | |

| Kijun Ahn | Daniel Cho |

| Haeyoung Cho | Janice Chung |

| Sang Young Lee | Hong Kyun “Daniel” Park |

| Don Rhee | Henry Kim |

2.2023 Equity BasedAdvisory Vote on Executive Compensation Plan.. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

3.Frequency of Advisory Vote on Executive Compensation. To approve, on a non-binding advisory basis, whether future shareholder advisory votes on the compensation of the Company’s named executive officers should be held every one, two or three years.

4.Bylaw Amendment. To approve an amendment to the Company’s 2023 Equity Based Compensation Plan.bylaws authorizing a range of seven to 13 directors.

3.5.Independent Registered Public Accounting Firm. To ratify the appointment of Crowe LLP as ourthe Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023.2024.

4.6.Other Business. Any other matters that may properly be brought before the meeting.

Only those shareholders of record at the close of business on March 28, 2024 are entitled to notice of and to vote at the meeting by order of the Board of Directors.or any adjournments or postponements thereof.

Important Notice Regarding the Availability of Proxy Materials: On or about April 12, 2023,8, 2024, we mailed to our shareholders a Notice Regarding the Availability of Proxy Materials, or the Notice, containing instructions for how to access our proxy statement for the Annual Meeting and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.2023. As described in the Notice, the proxy statement and the 20222023 Annual Report can be accessed online by visiting the website identified in the Notice and following the instructions. The Notice also provides instructions on how to vote your shares electronically as well as how to request a paper copy of the proxy statement and 20222023 Annual Report and vote your shares by mail using the proxy card.

Only those shareholders of record at the close of business on March 31, 2023 are entitled to notice of and to vote at the meeting or any adjournments or postponements thereof.

The bylaws of the Company provide for the nomination of directors in accordance with the following procedures:

“Section 2.14. Nominations of Directors. Nominations for election to the Board of Directors of the corporation may be made by the Board of Directors or by any shareholder of the corporation’s stock entitled to vote for the election of directors. Nominations, other than those made by or on behalf of the existing management of the corporation, shall be made in writing and shall be delivered or mailed to the president of the corporation not less than 14 days nor more than 50 days prior to any meeting of shareholders called for the election of directors; provided, however, that if less than 21 days’ notice of the meeting is given to shareholders, such nomination shall be mailed or delivered to the president of the corporation not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification shall contain the following information to the extent known by the notifying shareholder: (a) the name and address of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the total number of shares of common stock of the corporation that will be voted for each proposed nominee; (d) the name and residence address of the notifying shareholder; and (e) the number of shares of common stock of the corporation owned by the notifying shareholder. Nominations not made in accordance herewith shall, in his/her discretion, be disregarded by the chairman of the meeting, and upon his/her instructions, the inspectors of election shall disregard all votes cast for each such nominee.”

IT IS VERY IMPORTANT THAT EVERY SHAREHOLDER VOTE. WE URGE YOU TO VOTE YOUR SHARES ELECTRONICALLY, OR IF YOU REQUEST A PAPER COPY, TO SIGN AND RETURN THE ATTACHED PROXY CARD IN THE POSTAGE PAID ENVELOPE PROVIDED WITH THE NOTICE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON. IF YOU DO ATTEND THE MEETING AND YOU WISH TO CHANGE YOUR VOTE, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON AT THAT TIME. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO ITS EXERCISE.It is very important that every shareholder vote. We urge you to vote your shares electronically, or if you have received a paper proxy card, to sign and return it in the provided postage paid envelope as promptly as possible, whether or not you plan to attend the meeting in person. If you attend the Annual Meeting and you wish to change your vote, you may withdraw your proxy and vote in person at that time. You may revoke your proxy at any time prior to its exercise.

PLEASE INDICATE ON THE PROXY CARD WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING SO WE CAN PROVIDE ADEQUATE ACCOMMODATIONS.Please indicate on the proxy card whether or not you expect to attend the meeting so we can provide adequate accommodations.

We appreciate your continuing support and look forward to seeing you at the Annual Meeting.

| | | | | | | | | | | |

| | | By Order of the Board of Directors |

| | | |

| | | /s/ Andrew Chung |

| | | Andrew Chung

Executive Vice President, Chief Risk Officer and

Corporate Secretary |

| | | |

| | | Los Angeles, California |

| | | April 12, 20238, 2024 |

Please vote promptly.

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 25, 202323, 2024

PROXY STATEMENT SUMMARY

This proxy statement relates to the solicitation of proxies for the Annual Meeting of Shareholders of PCB Bancorp (the “Company” or “we”) to be held at the Company’s headquarters at 3701 Wilshire Boulevard, Suite 900, Los Angeles, California on May 25, 2023,23, 2024, at 10:30 a.m. Pacific Time and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, if you are a shareholder of record on March 31, 202328, 2024 (the “Record Date”), you will:may:

•Vote on the election of eight (8) directors.

•Vote to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

•Vote, on a non-binding advisory basis, whether future shareholder advisory votes on the approvalcompensation of the Company’s 2023 Equity Based Compensation Plan.named executive officers should be held every one, two or three years.

•Vote to approve an amendment to the Company’s bylaws authorizing a range of seven to 13 directors, an increase from the current range of five to nine.

•Vote on the ratification of the selection of the Company’s independent public accounting firm.

•Vote on any other matters that may properly come before the Annual Meeting.

We first made this proxy statement, the Notice of Annual Meeting of Shareholders and the attachedour proxy card available over the Internet on or about April 12, 20238, 2024 to all shareholders entitled to vote. If you owned common stock of the Company at the close of business on the Record Date, you are entitled to vote at the Annual Meeting. On the Record Date, there were 14,297,870 shares of Company common stock outstanding entitled to vote.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with the Securities and Exchange Commission (the “SEC”) rules and regulations, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022,2023, primarily via the Internet. Accordingly, on or about April 12, 2023,8, 2024, we mailed to our shareholders a “Notice Regarding the Availability of Proxy Materials,"” or the Notice, that contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals to be voted upon at the Annual Meeting, and how to request paper copies of this proxy statement and the 20222023 Annual Report. Shareholders may request to receive all future proxy materials from us in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual shareholder meetings and to reduce our costs.

GENERAL INFORMATION ABOUT THE 20232024 ANNUAL MEETING

PCB Bancorp, a corporation existing

Voting Securities and organized under the lawsRequired Quorum

There were 14,263,791 shares of the State of California and parent of its wholly owned subsidiary PCB Bank (the “Bank”) is authorized to issue up to 60,000,000 shares ofCompany’s common stock issued and 10,000,000 sharesoutstanding on March 28, 2024, which has been set as the record date for the purpose of preferred stock. Only those commondetermining the shareholders of record as of the Record Date will be entitled to notice of and to vote at the Annual Meeting. On that date, 14,297,870 shares of common stock were outstanding. The determination of shareholders entitled to vote at the meeting and the number of votes to which they are entitled was made on the basis of the Company’s records as of the Record Date. The presence, in person or by proxy, (including internetof at least a majority of the total number of outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting for the transaction of business. Abstentions and telephone voting)broker non-votes (defined below) are included in the determination of the number of shares present for determining a quorum but are not counted as voting on any matters brought before the Annual Meeting.

Each shareholder is entitled to one vote on each proposal per share of common stock held as of the Record Date. Shareholders do not have cumulative voting rights in connection with the election of directors.

Votes Required For Approval of the Proposals

In the election of directors, the eight nominees receiving the greatest number of votes will be elected as directors to serve until the 2025 Annual Meeting of Shareholders, even if those nominees do not receive a majority of the votes cast. Shares represented by proxies that are marked with instructions to “withhold authority” for the election of one or more director nominees or that are not voted (whether by abstention, broker non-vote or otherwise) will not be counted in determining the number of votes cast for those persons and will not affect the outcome of the election.

For the proposals to approve the compensation of our executive officers and the ratification of the appointment of our independent registered public accounting firm, the approval requires the affirmative vote of a majority of votes cast at the Annual Meeting, provided that such majority also represents a majority of the shares needed for quorum. Abstentions and broker non-votes will therefore have no effect on this vote, unless there are a number of abstentions or broker non-votes such that the votes in favor represent less than a majority of the shares needed for a quorum.

For the vote on the frequency of advisory votes on executive compensation, the option for holding an advisory vote every one year, two years, or three years receiving the greatest number of votes will be considered the preferred frequency of the shareholders. Therefore, broker non-votes and abstentions will not affect the outcome of this proposal.

The proposal to amend the Company’s bylaws requires the affirmative vote of a majority of the outstanding shares of common stock entitledoutstanding on the Record Date. Therefore, broker non-votes and abstentions will have the same effect as votes against the proposal.

Voting Shares Held by Brokers, Banks and Other Nominees

The Company asks brokers, banks and other nominee holders to vote at the Annual Meeting will constitute a quorum for the purpose of transacting business at the meeting. Abstentions, shares as to whichobtain voting authority has been withheld from any nominee and “broker non-votes” (as defined below), will be counted for purposes of determining the presence or absence of a quorum.

A broker or nominee holding shares for beneficial owners may vote on certain matters at the meeting pursuant to discretionary authority or instructions from the beneficial owners butof common stock. Proxies that are returned to us by brokers, banks or other nominee holders on your behalf will count toward a quorum and will be voted in accordance with the voting instructions you have sent to your broker, bank or other nominee holder. If, however, you want to vote your shares in person at the Annual Meeting, you will need to obtain a legal proxy or broker’s proxy card from your broker, bank or other nominee holder and bring it with you to the Annual Meeting. If you fail to provide voting instructions to, or you attend the Annual Meeting and do not obtain a legal proxy or broker’s proxy from, your broker, bank or other nominee, your shares will not be voted, except as provided below with respect to other matters for which the broker or nominee may not have received instructions from the beneficial owners and may not have discretionary voting power under thecertain “routine” matters.

Under rules applicable rule of the New York Stock Exchange or other self-regulatory organizations to which the broker or nominee is a member, the shares held by the broker or nominee may not be voted. Such un-voted shares are called “broker non-votes.” The rules of the New York Stock Exchange, and other self-regulatory organizations generally permitsecurities brokerage firms, a broker or nominee,who holds shares in the absence of instructions, to deliver“street name” for a proxy tocustomer may generally vote for routine items,your shares in its discretion on “routine” proposals, such as the ratification of the selection of the Company’s independent public accounting firm. Consequently,firm, but does not have the authority to vote those shares on any “non-routine” proposal, except in accordance with your voting instructions. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization, or third parties acting on its behalf. If your broker or nomineedoes not receive voting instructions from you, but chooses to vote your shares on a routine matter, then your shares will be deemed to be present by proxy and will count toward a quorum at the Annual Meeting, but will not be counted as having been voted on, and as a result will be deemed to constitute “broker non-votes” regardingwith respect to, non-routine items, such as the election of directors. It is important that you provide voting instructions to your broker or nominee.proposals.

Revocability of Proxies

A proxy for use atAny shareholder who is the meeting is attached. Any shareholderrecord owner of shares who executes and delivers sucha proxy has the right to revoke it at any time before it is exercised by filing with the Corporate Secretary of the Company an instrument revoking it or by filing a duly executed proxy bearing a later date. In addition, the powers of the proxy holder will be revoked if the person executing the proxy is present at the meeting,Annual Meeting, revokes such proxy, and elects to vote in person. Subject to such revocation, all shares represented by a properly executed proxy received in time for the meetingAnnual Meeting will be voted by the proxy holders in accordance with the instructions on the proxy.

IF NO INSTRUCTION IS SPECIFIED WITH REGARD TO A MATTER TO BE ACTED UPON, THE SHARES REPRESENTED BY THE PROXY WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS “FOR” THE ELECTION OF ALL NOMINEESHowever, if your shares are held by a broker, bank or other nominee holder, you will need to contact your broker, bank or the nominee holder if you wish to change or revoke any voting instructions that you previously gave to your broker, bank or other nominee holder.

Recommendations of the Board of Directors

The Board of Directors recommends that you vote FOR DIRECTOR LISTED HEREIN, “FOR” THE APPROVAL OF THE COMPANY’S 2023 EQUITY BASED COMPENSATION PLAN, AND “FOR” RATIFICATION OF THE SELECTION OF THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTING FIRMthe election of each director nominee named in this proxy statement; FOR 2023.approval, on a non-binding advisory basis, the compensation of the Company’s named executive officers; for future advisory votes on executive compensation to be held every year; FOR approval of the bylaw amendment and FOR ratification of the selection of the Company’s independent public accounting firm.

Person

Voting of Shares Represented by Proxy

If you grant us your proxy to vote your shares (whether by telephone or over the internet or by completing, signing and returning your proxy card by mail), and you do not revoke that proxy prior to the Annual Meeting, your shares will be voted as directed by you. If you grant us your proxy without providing any specific direction as to how your shares should be voted, your shares will be in accordance with the recommendations of the Board of Directors.

If any other matter should be properly presented at the Annual Meeting upon which a vote may be taken, the shares represented by your proxy will be voted in accordance with the judgment of the holders of the proxy. Such persons also have discretionary authority to vote to adjourn the Annual Meeting, including for soliciting additional proxies to vote in accordance with the recommendations of the Board of Directors on any of the above items.

Persons Making the Solicitation

This solicitation of proxies is being made by the Board of Directors of the Company. The expense of preparing, assembling, printing, and mailing the Notice and/or this proxy statement and the material used in the solicitation of proxies for the meeting will be borne by the Company. It is contemplated that proxies will be solicited principally through the use of the mail, but officers, directors, and employees of the Company and the Bank may solicit proxies personally or by telephone, without receiving special compensation therefor. Although there is no formal agreement to do so, the Company may reimburse banks, brokerage houses, and other custodians, nominees, and fiduciaries for their reasonable expense in forwarding these proxy materials to their principals.

Voting Rights

There were 14,297,870 shares of the Company’s common stock issued and outstanding on March 31, 2023, which has been set as the record date for the purpose of determining the shareholders entitled to notice of and to vote at the meeting. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of our common stock is necessary to constitute a quorum at the meeting for the transaction of business. Abstentions and broker non-votes are each included in the determination of the number of shares present for determining a quorum but are not counted on any matters brought before the meeting.

Each shareholder is entitled to one vote on each proposal per share of common stock held as of the record date. Shareholders do not have cumulative voting rights in connection with the election of directors. The election of eight (8) directors to serve until the 2024 Annual Meeting of Shareholders requires approval by a “plurality” of the votes cast by the shares of common stock entitled to vote in the election. This means that the eight (8) nominees who receive the highest number of properly cast votes will be elected as directors even if those nominees do not receive a majority of the votes cast. Shares represented by proxies that are marked with instructions to “withhold authority” for the election of one or more director nominees or that are not voted (whether by abstention, broker non-vote or otherwise) will not be counted in determining the number of votes cast for those persons.

For all other matters, including the approval of the new equity based compensation plan and ratification of the appointment of our accountants, a majority of votes cast shall decide the outcome of each matter submitted to the shareholders at the meeting. Abstentions will be included in the vote totals and, as such, will have the same effect on proposals as a negative vote. Broker non-votes (i.e., the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on the matter), if any, will not be included in vote totals and, as such, will have no effect on any proposal.

PROPOSAL NO. 1

ELECTION OF DIRECTORS OF THE COMPANY

Executive Summary

In accordance with the Company’s bylaws, the number of directors may be no less than five (5) and no more than nine, (9). Currently,with the specific number within the range set by resolution of the Board of Directors (the “Board”) or the shareholders. Currently, the Board has nine (9) members. The number ofeight directors authorized for electionand eight directors will be elected at the Annual Meeting is eight (8) in anticipation of the planned retirement of Director Sarah Jun effective as of the Annual Meeting. Each director will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected and qualified.

Unless authority to vote for the election of any directors is withheld, all proxies will be voted for the election of the eight (8) nominees listed below and recommended by the Board. The nominees receiving the highest number of affirmative votes of the shares entitled to be voted for them shall be elected as directors. Abstentions, broker non-votes and votes cast against nominees have no effect on the election of directors. If any of the nominees should unexpectedly decline or be unable to act as a director, their proxies may be voted for a substitute nominee to be designated by the Board.Board or the Board may reduce the number of directors to be elected at the Annual Meeting. The Board has no reason to believe that any nominee will become unavailable and has no present intention to nominate persons in addition to or in lieu of those named below.

Director Nomination Process

The Board formed a Nominating and Governance Committee to, among other things, assist the Board in identifying appropriate candidates for Board membership. As specified in its charter, the Nominating and Governance Committee is appointed by the Board of the Company to help the Board identify qualified individuals to become members of the Board, consistent with criteria approved by the Board, and to recommend to the Board the director nominees for the annual meetings of shareholders. All nominees for director identified in this proxy statement were approved and recommended by the Nominating and Governance Committee for inclusion on the proxy card and were recommended for such inclusion by the Committee. The Nominating and Governance Committee will utilize the same standards for evaluating director candidates recommended by shareholders as it does for candidates proposed by the Board or members thereof.

The Nominating and Governance Committee considers many factors in nominating individuals to serve on the Board, including the following:

•satisfactory results of any background investigation;

•business and professional experience and expertise;

•financial resources;

•ability to devote the time and effort necessary to fulfill the responsibilities of a director;

•involvement in community activities in the market areas served by the Company and its affiliates that may enhance the reputation of the Company and its affiliates;

•a candidate’s contribution to an appropriate balance on the Board of professional knowledge, business expertise, varied industry knowledge, and financial expertise;

•basic knowledge of the banking industry, financial regulatory system, and laws and regulation that govern the Company and its subsidiaries; and

•“independence” and “financial literacy,” as defined under applicable rules promulgated by the SEC pursuant to the Sarbanes-Oxley Act of 2002, and Nasdaq Listing Rules.

Shareholders who wish to make suggestions or recommendations about director nominations should forward their written suggestions to the Chairman of the Board addressed to PCB Bancorp, Attn: Corporate Secretary, 3701 Wilshire Boulevard, Suite 900, Los Angeles, California 90010. Submission of a recommendation in this fashion does not constitute a formal nomination under the Company’s bylaws. See “Other Matters -- Shareholder Nominations and Proposals” below. While the Board carefully considers diversity of professional disciplines and backgrounds when evaluating director candidates, it has not adopted a formal diversity policy. At present, the Board does not engage a third party to identify and evaluate potential director candidates.

Director Nominee Qualifications and Experience

The Board currently consists of nine (9)eight members, eight (8)each of whom are nomineesis a nominee for election at the Annual Meeting, and eachMeeting.Each of whom isthe directors will be elected annually at the annual meeting of shareholders andto serve a one-year terms,term, until their successors are duly elected and qualified. Pursuant to our bylaws, the Board is authorized to have a range of between five (5) and nine (9) directors, with the specific number within the range set by resolution of the Board. Our directors are not required to be a shareholder of the Company in order to qualify to serve as a director. All current directors of the Company, except Don Rhee, also serve as directors of the Bank.Company’s subsidiary, PCB Bank (the “Bank”). As discussed in greater detail below, the Board has affirmatively determined that, during the last fiscal year, eight (8)seven of our nine (9)eight directors qualified as independent directors based upon the rules of the Nasdaq and the SEC. There are no arrangements or understandings between any of the directors and any other person pursuant to which he or she was selected as a director.

The following table sets forth certain summary information about our current directors, including their names, ages, and the year in which they began serving as a director and any committee memberships they may hold. No current director has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers. None of our directors has been involved in any bankruptcy or criminal proceedings, nor have there been any judgments or injunctions brought against any of our directors during the last ten years that we consider material to the evaluation of the ability and integrity of any director.

| | | Committee Membership | | Committee Membership |

| Name and Position | Name and Position | | Age | | Director Since | | Audit | | Compensation | | Nominating and Governance | Name and Position | | Age | | Director Since | | Audit | | Compensation | | Nominating and Governance |

| Kijun Ahn, Ph.D. | Kijun Ahn, Ph.D. | | 67 | | 2007 (1) | | | | Chair | | Member | Kijun Ahn, Ph.D. | | 68 | | 2007 (1) | | | | Chair | | Member |

| Daniel Cho | Daniel Cho | | 58 | | 2020 | | Member | | Member | | Daniel Cho | | 59 | | 2020 | | Member | | Member | |

| Haeyoung Cho | Haeyoung Cho | | 68 | | 2011 | | Member | | Member | | Haeyoung Cho | | 69 | | 2011 | | | | | |

| Janice Chung | Janice Chung | | 66 | | 2021 | | Member | | Janice Chung | | 67 | | 2021 | | Member | |

| Sarah Jun | | 64 | | 2020 | | Member | | Member | | |

| Sang Young Lee, Chairman | Sang Young Lee, Chairman | | 72 | | 2007 | | Member | | Chair | Sang Young Lee, Chairman | | 73 | | 2007 | | Member | | Chair |

| Hong Kyun “Daniel” Park | Hong Kyun “Daniel” Park | | 64 | | 2015 | | Chair (2) | | Hong Kyun “Daniel” Park | | 65 | | 2015 | | Chair (2) | |

| Don Rhee | Don Rhee | | 67 | | 2015 | | Member | | Member | Don Rhee | | 68 | | 2015 | | Member | | Member |

| Henry Kim, President & Chief Executive Officer | Henry Kim, President & Chief Executive Officer | | 56 | | 2018 | | Henry Kim, President & Chief Executive Officer | | 57 | | 2018 | |

|

(1)Dr. Ahn has been a director for the Company since 2007, except for the year of 2014.

(2)Mr. Park serves as the Audit Committee financial expert.

None of the Company’s directors is a director of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940, whose common stock is registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended.

The business experience of each of the current directors, who are nominees for election at the Annual Meeting is set forth below.

Kijun Ahn, Ph.D. As one of the founding members of the Boards of the Company and the Bank, Dr. Ahn has extensive knowledge and experience in the fields of civil engineering and construction and provides the Board with valuable insights with regards to the Bank’s customers and issues involving these industries. Dr. Ahn iswas a project manager at Moffatt and Nichol, a global infrastructure advisory firm that specializes in structural, coastal, and civil engineering; environmental sciences; economics analysis; inspection and rehabilitation; and program management solutions. Throughout his 30 plus years of experience in the construction and development field, Dr. Ahn has managed many major projects, including public infrastructure projects in the state of California and Hawaii. Dr. Ahn earned his Bachelor of Science degree from Seoul National University in Seoul, Korea and Doctorate degree in Civil Engineering from Washington University in St. Louis, Missouri.

Daniel Cho. Mr. Cho has served on the Board of the Bank since April 2017 and on the Board of the Company since May 2020. Mr. Cho is a highly accomplished entrepreneur and a subject matter expert in Bank Secrecy Act and Anti-Money Laundering (“BSA/AML”) compliance and Fintech. Mr. Cho founded Banker’s Toolbox in 2000, which served over 750 banks and credit unions in the U.S as a leader in BSA/AML software. Mr. Cho sold Banker’s Toolbox in 2015. Prior to Banker’s Toolbox, Mr. Cho was a banker for 12 years working as an SBA loan manager and an IT manager. Mr. Cho has served as the Chief Executive Officer of Maya Tech since August 2016. Mr. Cho brings the Board valuable experience regarding BSA/AML compliance, banking and technology matters. Mr. Cho holds a Bachelor of Arts degree in Economics from University of California at Berkeley.

Haeyoung Cho. Ms. Cho was the President and Chief Executive Officer of the Company and the Bank from October 2011 until her retirement in December 2017. Ms. Cho is one of the founding executives of the Bank and played an instrumental role in successfully navigating the institution through the financial crisis and growing the Bank into an institution with over a billion dollars in assets. Ms. Cho began her banking career in 1983 and brings over 36 years of Korean-American community banking experience. As a career banking executive and the Company’s former President and Chief Executive Officer, Ms. Cho brings the Board deep banking expertise and insights regarding the Bank’s operations. Ms. Cho earned her Bachelor of Arts degree in business administration from Duksung University in Seoul, Korea and a Master of Business Administration degree from University of Phoenix. Ms. Cho also attended the Graduate School of Banking at Colorado in Denver, Colorado.

Janice Chung. Ms. Chung has served on the Boards of the Company and the Bank since November 2021. Ms. Chung is the Chief Executive Officer of BIC Technologies Group, a firm that specializes in providing technology and engineering services to companies processing rare metals, including titanium dioxide and base materials for solar cells and semi-conductors, primarily to global companies in South Korea and China.China, since 2016. Prior to BIC Technologies Group, from 1999 to 2002, Ms. Chung was the Chief Executive Officer of cyberPulse Network Group that provided innovation-focused management consulting services to South Korean public and private sectors including startup venture incubation, raising capital for the startups, strategic business planning, technology transfer, technology commercialization in the global market and structuring new business investments. From 1996 to 1998, Ms. Chung, as a Certified Public Accountant, was a partner at Coopers & Lybrand LLP, now known as, PricewaterhouseCoopers, at its International Tax Division in New York. Ms. Chung brings the Board valuable management, executive and accounting experience. Ms. Chung earned her Bachelor of Science degree in business administration from the University of Southern California.

Henry Kim. Mr. Kim served as the Chief Credit Officer, Chief Operating Officer and Corporate Secretary since the formation of the Bank in September 2003.In January 2018, Mr. Kim was promoted as the President and Chief Executive Officer of PCB Bancorp and PCB Bank. Mr. Kim is currently a member of the Board of Directors for both the Company and the Bank. As the Bank’s Chief Operating Officer, Mr. Kim spearheaded the expansion of the Bank’s branch network in Southern California and into the greater New York City metropolitan market, and led the expansion of extensive loan production office network in seven different states. As the President and Chief Executive Officer, he successfully took the Company public in August 2018. Under Mr. Kim’s leadership and growth strategies, the Bank’s total assets consistently increased from $1.44 billion at December 31, 2017 to $2.79 billion at December 31, 2023, and the Company’s shareholders’ equity increased from $142.2 million to $348.9 million over that same time period. In addition to being an experienced banker, as the Company’s President and Chief Executive Officer, Mr. Kim brings the Board valuable insights regarding the Company’s operations. Mr. Kim is a graduate of University of California at Santa Barbara with a BS degree in Applied Mathematics in 1989, and graduated from Pacific Coast Banking School in 2012.

Sang Young Lee. Mr. Lee is one of the founding members of the Boards of the Company and the Bank, and the current Chairman of the Boards of the Company and the Bank. Mr. Lee has served as the President and Chief Executive Officer of Lee’s Gold & Diamond Import, Inc. since 1988. Founded in 1988, Lee’s Gold & Diamond Import, Inc. specializes in wholesale distribution of various jewelry products in the greater Los Angeles area. Mr. Lee provides the Board with extensive insight into the trade industry and also possesses the business acumen and knowledge of the economic environment in that industry which is a tremendous asset to the Board. Mr. Lee also previously served as the Chairman of the Boards of the Company and the Bank from 2009 to 2012. Mr. Lee earned his Bachelor of Arts degree in law from Han Yang University and a Master of Business Administration degree in International Trade from Korea University in Seoul, Korea.

Hong Kyun “Daniel” Park. Mr. Park has served on the Boards of the Company and the Bank since 2015. He is a Certified Public Accountant and a managing partner of KNP, LLP, a greater Los Angeles-based accounting firm, where he has served both international and domestic middle market companies since 2017. Prior to that, Mr. Park was a partner of CKP, LLP, an accounting firm, from 2012 to 2016. Mr. Park brings over 30 years of business and accounting experience to the Board, having previously served with such prestigious accounting firms as Ernst & Young, Arthur Andersen, PwC, Deloitte & Touche, and also served as the Chief Financial Officer of several private companies. Mr. Park’s in-depth knowledge of accounting principles and auditing standards generally accepted in the U.S., as well as his valuable perspective on various industries, is a tremendous asset to the Board. Mr. Park is currently a member of AICPA and the California CPA Society. He had also served over 15 years on the Board of Governors at City Club Los Angeles. Mr. Park earned his Bachelor of Arts degree in Economics and Business from University of California at Los Angeles.

Don Rhee. Mr. Rhee has served on the Board of the Company since 2015. In 1988, Mr. Rhee founded Active USA, Inc., a Los Angeles-based apparel manufacturer, where he currently serves as the President and Chief Executive Officer. Mr. Rhee is a prominent leader in the Korean-American apparel business owners’ community, becoming the President of San Pedro Fashion Mart Association in 2013 and Chief Executive Officer of The World Korean Business Convention in 2015. From 1999 to 2011, Mr. Rhee was a director at Saehan Bancorp, which merged into a bank that eventually became a part of Bank of Hope. Mr. Rhee has extensive experience in the apparel manufacturing industry and a deep understanding of the commercial customers’ banking needs. In February 2023, Mr. Rhee was awarded the Dongbaek (Camellia) Medal of the Order of Civil Merit, one of the highest civilian awards, from the Korean government for his many philanthropic activities and significant meritorious contributions to the field of education. Mr. Rhee earned his Bachelor of Science degree in Architecture and an honorary Doctorate in business administration from Yeungnam University in Korea.

Henry Kim. Mr. Kim served as the Chief Credit Officer, Chief Operating Officer and Corporate Secretary since the formation of the Bank in September 2003. In January 2018, Mr. Kim was promoted as the President and Chief Executive Officer of PCB Bancorp and PCB Bank. Mr. Kim is currently a member of the Board of Directors for both the Company and the Bank. While serving as the Bank’s Chief Operating Officer, Mr. Kim spearheaded the expansion of the Bank’s branch network in Southern California and into the greater New York City metropolitan market, and led the expansion of extensive loan production office network in seven (7) different states. As the President and Chief Executive Officer, he successfully took the Company public in August 2018. Under Mr. Kim’s leadership and growth strategies, the Bank’s total assets consistently increased from $1.44 billion at December 31, 2017 to $2.42 billion at December 31, 2022, and our equity increased from $142.2 million to $335.4 million over that same time period. Mr. Kim is a graduate of University of California at Santa Barbara with a BS degree in Applied Mathematics in 1989, and graduated from Pacific Coast Banking School in 2012.

Compensation of Directors

The following table sets forth information regarding 20222023 compensation for each of our non-employee directors.

| | Name | Name | | Fees Earned and Paid in Cash (1) | | Equity Awards | | All Other Compensation (2) | | Total | Name | | Fees Earned and Paid in Cash (1) | | Equity Awards | | All Other Compensation (2) | | Total |

| Kijun Ahn | Kijun Ahn | | $ | 64,000 | | | $ | — | | | $ | 24,000 | | | $ | 88,000 | | Kijun Ahn | | $ | 67,000 | | | $ | — | | | $ | 24,000 | | | $ | 91,000 | |

| Daniel Cho | Daniel Cho | | $ | 75,500 | | | $ | — | | | $ | 17,442 | | | $ | 92,942 | | Daniel Cho | | $ | 79,000 | | | $ | — | | | $ | 21,523 | | | $ | 100,523 | |

| Haeyoung Cho | Haeyoung Cho | | $ | 64,000 | | | $ | — | | | $ | 84,000 | | | $ | 148,000 | | Haeyoung Cho | | $ | 67,000 | | | $ | — | | | $ | 84,000 | | | $ | 151,000 | |

| Janice Chung | Janice Chung | | $ | 61,500 | | | $ | — | | | $ | 24,000 | | | $ | 85,500 | | Janice Chung | | $ | 67,000 | | | $ | — | | | $ | 24,000 | | | $ | 91,000 | |

| Sarah Jun | | $ | 60,500 | | | $ | — | | | $ | 24,000 | | | $ | 84,500 | | |

| Sang Young Lee, Chairman | Sang Young Lee, Chairman | | $ | 76,000 | | | $ | — | | | $ | 24,000 | | | $ | 100,000 | | Sang Young Lee, Chairman | | $ | 79,000 | | | $ | — | | | $ | 24,000 | | | $ | 103,000 | |

| Hong Kyun ”Daniel” Park | Hong Kyun ”Daniel” Park | | $ | 64,000 | | | $ | — | | | $ | 17,000 | | | $ | 81,000 | | Hong Kyun ”Daniel” Park | | $ | 67,000 | | | $ | — | | | $ | 19,504 | | | $ | 86,504 | |

| Don Rhee | Don Rhee | | $ | 44,000 | | | $ | — | | | $ | 24,000 | | | $ | 68,000 | | Don Rhee | | $ | 49,000 | | | $ | — | | | $ | 24,000 | | | $ | 73,000 | |

|

(1)Amounts shown include payment of Board membership retainer fees for the Company and the Bank Board meetings, committee membership fees and specific purpose committee membership fees.

(2)All Other Compensation reflects health insurance benefits, except for abenefits. For Haeyoung Cho, includes $60,000 in consulting payment of $60,000 paid to Haeyoung Chofees.

Non-employee director fees for 2022 were based upon2023 reflect fees for service on both the Boards of the Company and the Bank. Non-employee directors of the Bank were paid a monthly retainer of $5,000,$6,000, while the Chairman of the Board of the Bank was paid a monthly retainer of $6,500.$7,500. In addition, non-executive directors of the Bank that also served on the director’s loan committee were paid an additional monthly retainer of $500 and chair of the Bank’s Risk and Compliance Committee (Director Daniel Cho), were paid an additional monthly retainer of $1,000. The member of the Board of the Company who did not also serve on the Board of the Bank (Director Don Rhee) was paid a monthly retainer of $4,000.$5,000.

The Board of Directors unanimously recommends a vote “FOR” each of the

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE

DIRECTORS NOMINATED FOR ELECTION IN PROPOSAL ONE.directors nominated for election in Proposal 1.

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Corporate Governance Guidelines

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. The Board has adopted Corporate Governance Guidelines, which set forth the framework within which the Board, assisted by the committees of the Board, oversees the affairs of our organization. The Corporate Governance Guidelines address, among other things, the composition and functions of the Board, director independence, compensation of directors, management succession and review, committees of the Board and selection of new directors. Our Corporate Governance Guidelines are available on our website at www.mypcbbank.com, by clicking “About Us,” then “Investor Relations,” then “Corporate Governance” and then “Governance Documents.”

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values. They should have broad experience at the policy-making level in business, government or banking. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on boards of other companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all the Company director duties. Each director must represent the interests of all shareholders. When considering potential director candidates, the Board also considers the candidate’s character, judgment, diversity of professional disciplines and backgrounds, skill sets, specific business background and global or international experience in the context of our needs and those of the Board.

Director Independence

Our common stock is currently listed on the Nasdaq Global Select Market and, as a result, we are required to comply with the rules of Nasdaq with respect to the independence of directors who serve on the Board and its committees. Under the rules of Nasdaq, independent directors must comprise a majority of the Board. The rules of Nasdaq, as well as those of the SEC, also impose several other requirements with respect to the independence of our directors.

The Board has evaluated the independence of its members based upon the rules of Nasdaq and the SEC. Applying these standards, the Board has affirmatively determined that eight (8)seven of the nine (9)our eight current directors and seven (7) of the eight (8) nominated directorsnominees qualify as independent directors: Kijun Ahn, Daniel Cho, Haeyoung Cho, Janice Chung, Sarah Jun, Sang Young Lee, Hong Kyun “Daniel” Park, and Don Rhee. As noted previously, Director Sarah Jun intends to retire effective as of the Annual Meeting. Henry Kim does not qualify as an independent director because he is an executive officer of the Company and the Bank. The Board has deemed it appropriate to have two separate individuals serve as Chairman of the Board and Chief Executive Officer, and that the Chairman satisfy the requirements for an independent director under the Nasdaq rules.

Board Diversity

| | Board Diversity Matrix (As of April 12, 2023) | | | |

| Board Diversity Matrix (As of April 8, 2024) | | Board Diversity Matrix (As of April 8, 2024) | | |

| | | Female | Male | | | Female | Male |

| Total Number of Directors | Total Number of Directors | | 9 | Total Number of Directors | | 8 |

| Part I: Gender Identity | Part I: Gender Identity | | | Part I: Gender Identity | | |

| Directors | Directors | | 3 | 6 | Directors | | 2 | 6 |

| Part II: Demographic Background | Part II: Demographic Background | | | Part II: Demographic Background | | |

| Asian | Asian | | 3 | 6 | Asian | | 2 | 6 |

Code of Ethics and Business Conduct

The Board has adopted a Code of Ethics and Business Conduct, which became effective September 22, 2016, and undergoes periodic review and revision. This code, which applies to all of our directors and employees.employees, serves as our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and our “code of conduct” for purposes of Nasdaq’s listing standards. The code provides fundamental ethical principles to which these individuals are expected to adhere to and will operateoperates as a tool to help our directors, officers and employees understand the high ethical standards required for employment by, or association with, the Company. In addition, the code specifically prohibits all forms of unlawful securities trading and hedging transactions, such as puts, calls, short sales, and other similar transactions involving securities issued by the Company. Our Code of Ethics and Business Conduct is available on our website at www.mypcbbank.com, by clicking “About Us,” then “Investor Relations,” then “Corporate Governance” and then “Governance Documents.” We expect that any amendments toTo the code,extent required by applicable SEC rules, Nasdaq’s listing standards or our Code of Ethics and Business Conduct, we will disclose any waivers of itsthe requirements willof the code that may be disclosedgranted to our executive officers, including our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions, on our website, as well as by any other means required by Nasdaq.website.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee (i) is or has ever been an employee of ours, except Ms. Cho, who was one of the founding executives of the Bank and served as the President and Chief Executive Officer of the Company and the Bank from 2011 through 2017, (ii) was, during the last completed fiscal year, a participant in any related party transaction requiring disclosure under “Certain Relationships and Related Party Transactions,” except with respect to loans made to such committee members in the ordinary course of business on substantially the same terms as those prevailing at the time for comparable transactions with unrelated parties or (iii) had, during the last completed fiscal year, any other interlocking relationship requiring disclosure under Item 404 of Regulations S-K concerning related party transactions. In 2023, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on our Board or its Compensation Committee.

Risk Management and Oversight

The Board oversees our risk management process, which is a company-wide approach to risk management that is carried out by our management. The Board determines the appropriate risk for us generally, assesses the specific risks faced by us, and reviews the steps taken by management to manage those risks. While the Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk within their particular area of concern. In particular, our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements, and the incentives created by the compensation awards it administers. Our Audit Committee is responsible for overseeing the management of risks associated with, among other things, related party transactions, internal controls and financial reporting. Our Nominating and Governance Committee oversees risks related to the nominees for election as directors as well as candidates for senior management positions, the functioning of our standing committees, and the compliance with our corporate governance guidelines. The Board monitors capital adequacy in relation to risk. Pursuant to the Board’s instruction, management regularly reports on applicable risks to the relevant committee or the Board, as appropriate, with additional review or reporting on risks conducted as needed or as requested by the Board and its committees.

Board Meetings and Committees

Meetings and Attendance

Directors are expected to attend all the Board meetings, all meetings of committees on which they serve, and the annual shareholders’ meeting. There were three (3)four regular meetings and five (5)three special meetings of the Board of the Company during the fiscal year ended December 31, 2022.2023. Each director standing for re-election to the Board attended at least 88%83% of the aggregate number of meetings of the Board and meetings held by all committees of the Board on which he or she served. All current directors except for Don Rhee, attended our 20222023 annual shareholders’shareholders meeting.

Shareholder Communications with the Board

Given the Company’s relatively small number of shareholders and infrequency of communication from shareholders to the Board, there is currently no formal process for shareholders to send communications directly to the Board. However, any shareholder may communicate directly to the Board members, or to any individual Board member, by sending correspondence or communication addressed to the particular member or members in care of PCB Bancorp, Attn: Corporate Secretary, 3701 Wilshire Boulevard, Suite 900, Los Angeles, California 90010.

Board Committees

The Board currently has three (3) standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. Each committee is comprised solely of directors that meet the definition of “independent director” under the Nasdaq rules, and each member of the audit committeeAudit Committee is independent under applicablethe SEC rules.and Nasdaq independence rules that apply to audit committee members. Each of the committees of the Board meets at such times as determined to be necessary.

The Board also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our articles and bylaws. We are not considered a “controlled company” within the meaning of the corporate governance standards of Nasdaq.

Audit Committee

The Audit Committee currently consists of Hong Kyun “Daniel” Park (Chairperson), Daniel Cho, Haeyoung Cho,and Janice Chung and Sarah Jun.Chung. The Board has affirmatively determined that each member of the Audit Committee also satisfies the additional independence standards under the Nasdaq rules and applicable SEC rules for audit committee service and has the ability to read and understand fundamental financial statements. In addition, the Board has determined that Hong Kyun “Daniel” Park qualifies as an “audit committee financial expert,” as that term is defined under the applicable SEC rules.

The Audit Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. As described in its charter, the Audit Committee has responsibility for, among other things:

•selecting and reviewing the performance of our independent auditors and approving, in advance, all engagements and fee arrangements;

•reviewing the independence of our independent auditors;

•reviewing actions by management on recommendations of the independent auditors and internal auditors; meeting with management, the internal auditors and the independent auditors to review their effectiveness;

•reviewing our system of internal control and internal audit procedures and results;

•reviewing earnings releases, financial statements and reports to be filed with the SEC or otherwise;

•reviewing and approving transactions involving potential conflicts of interest under our Code of Ethics and Business Conduct; and

•preparing an audit committee report and handling other such matters that are specifically delegated to the Audit Committee by the Board from time to time.

The committee held nine (9) meetings during the fiscal year ended December 31, 2022.

2023.

Nominating and Governance Committee

The Nominating and Governance Committee currently consists of Sang Young Lee (Chairperson), Kijun Ahn and Don Rhee. Each of the members of the Nominating and Governance Committee is “independent” as defined by our policy and Nasdaq rules. The Nominating and Governance Committee held one (1) meeting during the fiscal year ended December 31, 2022.2023.

The Nominating and Governance Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The Nominating and Governance Committee has responsibility for, among other things:

•recommending persons to be selected by the Board as nominees for election as directors or to fill any vacancies on the Board;

•assisting the Board with identifying, reviewing, and recommending individuals qualified to fill senior management positions at both the Company and the Bank levels;

•monitoring the functioning of our standing committees and recommending any changes, including the creation or elimination of any committee;

•conducting annual performance evaluations of the Board, including through requests and comments from all directors of the Board;

•developing, reviewing and monitoring compliance with our corporate governance guidelines, requirements of applicable laws, regulations, the Nasdaq rules, the Sarbanes-Oxley Act, and other federal banking laws;

•reviewing annually the composition of the Board and committees as a whole and making recommendations on the qualifications, independence, structure, and reporting of the same;

•reviewing Company’s shareholder proposals properly submitted, including any proposed amendments to our articles of incorporation or bylaws; and

•handling such other matters that are specifically delegated to the Nominating and Governance Committee by the Board from time to time.

Compensation Committee

The Compensation Committee currently consists of Kijun Ahn (Chairperson), Daniel Cho, Haeyoung Cho, Sarah Jun, Sang Young Lee and Don Rhee. The Compensation Committee held one (1)four meetings during the fiscal year ended December 31, 2022.2023. Each of the members serving on the Compensation Committee has been determined by the Board to be “independent” as such term is defined by Rule 5605(a)(2) of the Nasdaq’s current listing rules.

The Compensation Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The Compensation Committee may delegate its authority to its Chairperson, a subcommittee or others to the extent permitted by law and has granted the Chief Executive Officer the authority to approve, within specified limits, equity grants to new hires other than those who will be executive officers for purposes of Section 16 of the Securities Exchange Act. As described in its charter, the Compensation Committee has responsibility for, among other things:

•reviewing, monitoring and approving our overall compensation structure, policies and programs (including benefit plans) and assessing whether the compensation structure establishes appropriate incentives for our executive officers and other employees and meets our corporate objectives;

•determining the annual compensation of our Chief Executive Officer;

•establishing subjective and objective criteria to serve as the basis for other executive officers’ compensation and reviewing the compensation decisions made by our Chief Executive Officer with respect to our other named executive officers;

•reviewing the talent development and executive succession planning process with our Chief Executive Officer;

•overseeing the administration of our equity plans and other incentive compensation plans and programs and preparing recommendations and periodic reports to the Board relating to these matters;

•preparing the Compensation Committee report required by the SEC rules to be included in our annual report; and

•handling such other matters that are specifically delegated to the Compensation Committee by the Board from time to time.

Board Committee Charters

The Compensation, Audit, and Nominating and Governance Committee charters are available on the Company’s website at www.mypcbbank.com, by clicking “About Us,” then “Investor Relations,” then “Corporate Governance” and then “Governance Documents.”

Board Leadership Structure

It is the role of the Nominating and Governance Committee to annually review, and when appropriate make recommendations to the Board concerning board composition, structure, and functions. The Board has deemed it appropriate to have two separate individuals serve as Chairman of the Board and Chief Executive Officer. According to the Company’s bylaws, the Chairman of the Board shall preside at meetings of the Board and shareholders and exercise and perform such other powers and duties as may be from time to time assigned to him or her by the Board. The bylaws further provide that the President of the Company will be the Chief Executive Officer and shall, subject to the control of the Board, have general supervision, direction, and control of the business and the officers of the Company. As the oversight responsibilities of the Board grows, the Board believes it is beneficial to have an independent Chairman with the sole job of leading the Board, while allowing the President to focus his efforts on the day-to-day management of the Company and the Bank. The Board does believe that it is important to have the President as a director. The Company aims to foster an appropriate level of separation between these two distinct levels of leadership of the Company. In addition to the Chairman, leadership is also provided through the respective chairs of the Board’s various committees.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

AsThe following table sets forth the beneficial ownership as of March 31, 2023, based upon filings with the SEC, BlackRock, Inc. reported holding 773,946 shares, which represented 5.41%. The foregoing entities were the only shareholder28, 2024, of (1) each person who is known toby the Company to own beneficially more than 5% of the outstanding shares of the Company’s common stock except for Chairman Sang Young Lee and Director Don Rhee. The ownership of Chairman Sang Young Lee and Director Don Rhee is set forth in the Security Ownership of Management table below.

Security Ownership of Management

The following table sets forth information as of March 31, 2023, concerning beneficial ownership of our common stock asstock; (2) each of the record date owned byexecutive officers (as defined below); (3) each of the Company’s directors; and (4) all directors nominees for director, the currentand executive officers(1) and all directors, nominees and executive officersof the Company as a group. Beneficial ownership includes shared voting or dispositive power and options that are currently exercisable or exercisable within 60 days. All of the shares shown in the following table are owned both of record and beneficially except as indicated in the notes to the table. Each director has furnished to us information with respect to beneficial ownership of common stock.

| Name, Address of Beneficial Owner, and Relationship with Company (2) | Name, Address of Beneficial Owner, and Relationship with Company (2) | | Common Stock | | Number of Exercisable Options Within 60 Days | | Amount and Nature of Beneficial Ownership (3) | | Percent of Class | Name, Address of Beneficial Owner, and Relationship with Company (2) | | Common Stock | | Number of Exercisable Options Within 60 Days | | Amount and Nature of Beneficial Ownership (3) | | Percent of Class |

Kijun Ahn, Director | Kijun Ahn, Director | | 117,466 | | (4) | | 24,200 | | | 141,666 | | | ** | Kijun Ahn, Director | | 141,666 | | (4) | | — | | | 141,666 | | | ** |

Daniel Cho, Director | Daniel Cho, Director | | 123,000 | | (5) | | — | | | 123,000 | | | ** | Daniel Cho, Director | | 123,000 | | (5) | | — | | | 123,000 | | | ** |

Haeyoung Cho, Director | Haeyoung Cho, Director | | 241,104 | | (6) | | — | | | 241,104 | | | 1.69% | Haeyoung Cho, Director | | 241,104 | | (6) | | — | | | 241,104 | | | 1.69% |

Janice Chung, Director | Janice Chung, Director | | 9,700 | | (7) | | — | | | 9,700 | | | ** | Janice Chung, Director | | 9,700 | | (7) | | — | | | 9,700 | | | ** |

Sarah Jun, Director | | 233,528 | | (8) | | 24,200 | | | 257,728 | | | 1.80% | |

Sang Young Lee, Chairman of the Board | Sang Young Lee, Chairman of the Board | | 1,773,047 | | (9) | | — | | | 1,773,047 | | | 12.40% | Sang Young Lee, Chairman of the Board | | 1,887,555 | | (8) | | — | | | 1,887,555 | | | 13.23% |

Hong Kyun “Daniel” Park, Director | Hong Kyun “Daniel” Park, Director | | 24,200 | | | — | | | 24,200 | | | ** | Hong Kyun “Daniel” Park, Director | | 24,200 | | | — | | | 24,200 | | | ** |

Don Rhee, Director | Don Rhee, Director | | 707,959 | | (10) | | 14,520 | | | 722,479 | | | 5.05% | Don Rhee, Director | | 723,829 | | (9) | | — | | | 723,829 | | | 5.07% |

Henry Kim, President, Chief Executive Officer and Director | Henry Kim, President, Chief Executive Officer and Director | | 243,263 | | (11) | | 75,734 | | | 318,997 | | | 2.22% | Henry Kim, President, Chief Executive Officer and Director | | 244,263 | | (10) | | 74,734 | | | 318,997 | | | 2.22% |

Timothy Chang, Executive Vice President and Chief Financial Officer | Timothy Chang, Executive Vice President and Chief Financial Officer | | 40,725 | | (12) | | 30,000 | | | 70,725 | | | ** | Timothy Chang, Executive Vice President and Chief Financial Officer | | 43,725 | | (11) | | 27,000 | | | 70,725 | | | ** |

David W. Kim, Executive Vice President and Chief Banking Officer | David W. Kim, Executive Vice President and Chief Banking Officer | | 1,000 | | | 4,000 | | | 5,000 | | | ** | David W. Kim, Executive Vice President and Chief Banking Officer | | 1,000 | | | 8,000 | | | 9,000 | | | ** |

Andrew Chung, Executive Vice President and Chief Risk Officer | Andrew Chung, Executive Vice President and Chief Risk Officer | | 2,000 | | (13) | | 20,000 | | | 22,000 | | | ** | Andrew Chung, Executive Vice President and Chief Risk Officer | | 2,000 | | (12) | | 20,000 | | | 22,000 | | | ** |

Brian Bang, Executive Vice President and Chief Credit Officer | Brian Bang, Executive Vice President and Chief Credit Officer | | 16,230 | | (14) | | 15,126 | | | 31,356 | | | ** | Brian Bang, Executive Vice President and Chief Credit Officer | | 16,230 | | (13) | | 15,126 | | | 31,356 | | | ** |

| All directors and executive officers combined (As a group of 12) | All directors and executive officers combined (As a group of 12) | | 3,510,666 | | | 226,878 | | | 3,737,544 | | | 25.73% | All directors and executive officers combined (As a group of 12) | | 3,458,272 | | | 144,860 | | | 3,603,132 | | | 25.01% |

| | BlackRock, Inc. | | BlackRock, Inc. | | 819,182 | | (14) | | — | | | 819,182 | | | 5.74% |

|

** Represents less than 1% of outstanding.

(1)As used throughout, the term “executive officers” means the President and Chief Executive Officer, the Executive Vice President and Chief Financial Officer, the Executive Vice President and Chief Banking Officer, the Executive Vice President and Chief Risk Officer, and the Executive Vice President and Chief Credit Officer. The Chairman of the Board and our other officers are not treated as executive officers.

(2)Unless otherwise indicated, the address for all persons listed is c/o PCB Bank, 3701 Wilshire Boulevard, Suite 900, Los Angeles, California 90010.

(3)The table includes all shares beneficially owned on March 31, 2023,28, 2024, whether directly or indirectly, individually or together with associates, jointly or as community property with a spouse, unvested restricted stock awards (“RSAs”), which he or she has voting power, as well as any shares, including through the exercise of stock options, as to which beneficial ownership may be acquired within 60 days of March 31, 2023.28, 2024. The options are described in more detail in “Executive Compensation,” below.

(4)Includes 16,129 shares held by his children.

(5)Includes 123,000 shares held jointly by him and his spouse.

(6)Includes 217,541 shares held by her trust and 23,563 shares held by her IRA.

(7)Includes 1,000 shares held by her IRA.

(8)Includes 45,132 shares held by her spouse, 10,000 shares held by her son, and 931 shares held by her IRA

(9)Includes 1,352,1911,466,699 shares held by his family trust and 416,016 shares held by Lee’s Gold and Diamond Import, Inc.

(10)(9)Includes 393,294409,014 shares held by his family trust and 314,665314,815 shares held by Rhee Family Venture LLC.

(11)(10)Includes 59,992 shares held jointly by him and his spouse, 19,785 shares held by his IRA, 21,013 shares held by his spouse's IRA, and 35,26117,000 shares of unvested RSAs.

(12)(11)Includes 31,47425,824 shared held jointly by him and his spouse and 2,1001,000 shares of unvested RSAs.

(12)Includes 400 shares of unvested RSAs.

(13)Includes 800600 shares of unvested RSAs.

(14)Includes 1,200Based on an amended Schedule 13G filed with the SEC by BlackRock, Inc. (“BlackRock”) on January 29, 2024 indicating that as of December 31, 2023, BlackRock had sole dispositive power over 819,182 shares of unvested RSAs.and sole voting power over 804,608 shares. BlackRock's address is 55 East 52nd Street, New York, NY 10055

EXECUTIVE COMPENSATION

As an emerging growth company under the JOBS Act, we have opted to comply with the executive compensation disclosure rules applicable to “smaller reporting companies” as such term is defined in the rules promulgated under the Securities Exchange Act, which permit us to limit reporting of executive compensation to our principal executive officer and our two other most highly compensated executive officers, which are referred to as our “named executive officers.” We have chosen to include compensation information for a fourth senior executive officer.

The compensation reported in the Summary Compensation Table below is not necessarily indicative of how we will compensate our named executive officers in the future. We will continue to review, evaluate and modify our compensation framework to maintain a competitive total compensation package.

Executive Officers

Our named executive officers for 2022 are:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Henry Kim | | 5657 | | President and Chief Executive Officer |

| Timothy Chang | | 5455 | | Executive Vice President and Chief Financial Officer |

| David W. Kim | | 5758 | | Executive Vice President and Chief Banking Officer |

| Andrew Chung | | 6061 | | Executive Vice President and Chief Risk Officer |

| Brian Bang | | 4849 | | Executive Vice President and Chief Credit Officer of the Bank |

| | | | |

The business experience of each of the executives who are not otherwise directors of the Company is set forth below.

Timothy Chang. Mr. Chang serves as the Executive Vice President and Chief Financial Officer of the Company and the Bank. Mr. Chang has served as the Chief Financial Officer of the Company and the Bank since he joined us in 2010. In this role, he oversees all aspects of financial reporting including strategic planning, asset/liability management, taxation and regulatory filings. Mr. Chang has over 2223 years of commercial banking experience. Prior to joining us, Mr. Chang served as the Executive Vice President and Chief Financial Officer of Mirae Bank, the Senior Vice President and Chief Planning Officer of Hanmi Bank, and the Senior Vice President, Chief Financial Officer and Treasurer of Nara Bank. Mr. Chang is a Certified Public Accountant (inactive) and earned his Bachelor of Art degree in Economics from University of California, Los Angeles.

David W. Kim. Mr. Kim serves as the Executive Vice President and Chief Banking Officer of the Bank since he joined us in January 2022. Mr. Kim is responsible for oversight of the Bank’s retail branches and certain lending units. Prior to joining the Bank, Mr. Kim served as Executive Vice President and Regional President of Bank of Hope’s Midwest Region from July 2019 to December 2021. Prior to that, Mr. Kim served as Executive Vice President and Chief Retail Bank Officer of Bank of Hope from May 2017 to June 2019 and other various leadership positions of Bank of Hope from April 2014, Executive Vice President, Chief Operating Officer and General Counsel of United Central Bank, Executive Vice President and Chief Credit Officer of Commonwealth Business Bank, Senior Vice President, Chief Operating Officer and General Counsel of Wilshire State Bank, Senior Vice President, Chief Administrative Officer and General Counsel of Hanmi Bank. Mr. Kim began his banking career with Chase Bank in New York and the International Monetary Fund in Washington, D.C. Mr. Kim earned his Bachelor of Science degree in Economics and Public Policy from Indiana University and his Juris Doctor from George Washington University Law School.

Andrew Chung. Mr. Chung serves as the Executive Vice President and Chief Risk Officer of the Bank since he joined us in April 2018. Mr. Chung also serves as the Corporate Secretary of the Company. Mr. Chung has over 27 years of experience in banking and financial services. Prior to joining the Bank, Mr. Chung served as the Executive Vice President and Chief Financial Officer of Uniti Financial Corporation and Uniti Bank from November 2013 to April 2018, the Senior Vice President and Controller of Wilshire Bank from July 2011 to October 2013, and the Senior Vice President and Chief Financial Officer of the Bank from October 2005 to April 2010. Mr. Chung is a Certified Public Accountant (inactive) and earned his Master of Business Administration degree from Marshall School of Business, University of Southern California and Bachelor of Science degree in Business Administration from California State University, Los Angeles.

Brian Bang. Mr. Bang serves as the Executive Vice President and Chief Credit Officer of the Bank since January 2022. Mr. Bang joined the Bank in 2005, and served as the Senior Vice President & Deputy Chief Credit Officer between 2014 and 2017 and Senior Vice President and Chief Credit Officer between 2018 and 2021. Prior to 2014, Mr. Bang served as Senior Loan Officer and Credit Administration Manager. Mr. Bang also held loan officer positions in other Korean-American banks in Southern California. He has extensive experience in community banking as commercial, consumer, SBA lender and credit administrator. Mr. Bang received his Bachelor of Art degree in Business Administration from California State University, Fullerton. Mr. Bang also graduated from Pacific Coast Banking School, in partnership with the Graduate School of Business at University of Washington.

Summary Compensation Table

The following table sets forth information regarding the total compensation paid, awarded to, or earned for the fiscal years ended December 31, 20222023 and 2021 for each2022 of our namedChief Executive Officer and our two other most highly compensated executive officers. All compensation is paid byofficers during the Bank.year ended December 31, 2023, who we refer to as our “named executive officers.”

| | Name | Name | | Year | | Base Salary | | Short Term Cash Incentive | | Restricted Stock Awards (1) | | Stock Option Award | | All Other Compensation (2) | | Total | Name | | Year | | Base Salary | | Short Term Cash Incentive | | Restricted Stock Awards (1) | | Stock Option Award | | All Other Compensation (2) | | Total |

| Henry Kim | Henry Kim | | 2022 | | $ | 448,077 | | | $ | 400,000 | | | $ | 549,000 | | | $ | — | | | $ | 86,243 | | | $ | 1,483,320 | | Henry Kim | | 2023 | | $ | 498,077 | | | $ | 450,000 | | | $ | — | | | $ | 66,156 | | | $ | 83,923 | | | $ | 1,098,156 | |

| | 2021 | | $ | 398,270 | | | $ | — | | | $ | 350,002 | | | $ | — | | | $ | 74,405 | | | $ | 822,677 | | | 2022 | | $ | 448,077 | | | $ | 400,000 | | | $ | 549,000 | | | $ | — | | | $ | 86,243 | | | $ | 1,483,320 | |

| Timothy Chang | Timothy Chang | | 2022 | | $ | 278,425 | | | $ | 120,000 | | | $ | — | | | $ | — | | | $ | 39,636 | | | $ | 438,061 | | Timothy Chang | | 2023 | | $ | 297,692 | | | $ | 120,000 | | | $ | — | | | $ | — | | | $ | 40,145 | | | $ | 457,837 | |

| | 2021 | | $ | 236,574 | | | $ | 60,000 | | | $ | — | | | $ | — | | | $ | 34,811 | | | $ | 331,385 | | | 2022 | | $ | 278,425 | | | $ | 120,000 | | | $ | — | | | $ | — | | | $ | 39,636 | | | $ | 438,061 | |

| David W. Kim | David W. Kim | | 2022 | | $ | 269,231 | | | $ | — | | | $ | — | | | $ | 102,162 | | | $ | 87,692 | | | $ | 459,085 | | David W. Kim | | 2023 | | $ | 292,385 | | | $ | 70,000 | | | $ | — | | | $ | — | | | $ | 29,543 | | | $ | 391,928 | |

| Andrew Chung | | 2022 | | $ | 239,215 | | | $ | 70,000 | | | $ | — | | | $ | — | | | $ | 28,053 | | | $ | 337,268 | | |

| 2021 | | $ | 217,322 | | | $ | 40,000 | | | $ | — | | | $ | — | | | $ | 26,634 | | | $ | 283,956 | | |

| Brian Bang | | 2022 | | $ | 208,846 | | | $ | 70,000 | | | $ | — | | | $ | — | | | $ | 26,730 | | | $ | 305,576 | | |

| | 2021 | | $ | 174,618 | | | $ | 40,000 | | | $ | — | | | $ | — | | | $ | 23,265 | | | $ | 237,883 | | | 2022 | | $ | 269,231 | | | $ | — | | | $ | — | | | $ | 102,162 | | | $ | 87,692 | | | $ | 459,085 | |

| | |

(1) The amount represents the grant date fair value of the RSAs granted, calculated in accordance with FASB ASC Topic 718. Fair values of stock awards were valued at the closing price of the Company's common stock on the grant date of the awards.

(2) “All Other Compensation” for the named executive officers during the fiscal years ended December 31, 20222023 and 20212022 is summarized below.